How Fast is the AI Search Market Growing

Understanding the rapid expansion of Answer Engine Optimization tools, services, and market projections for 2025-2026

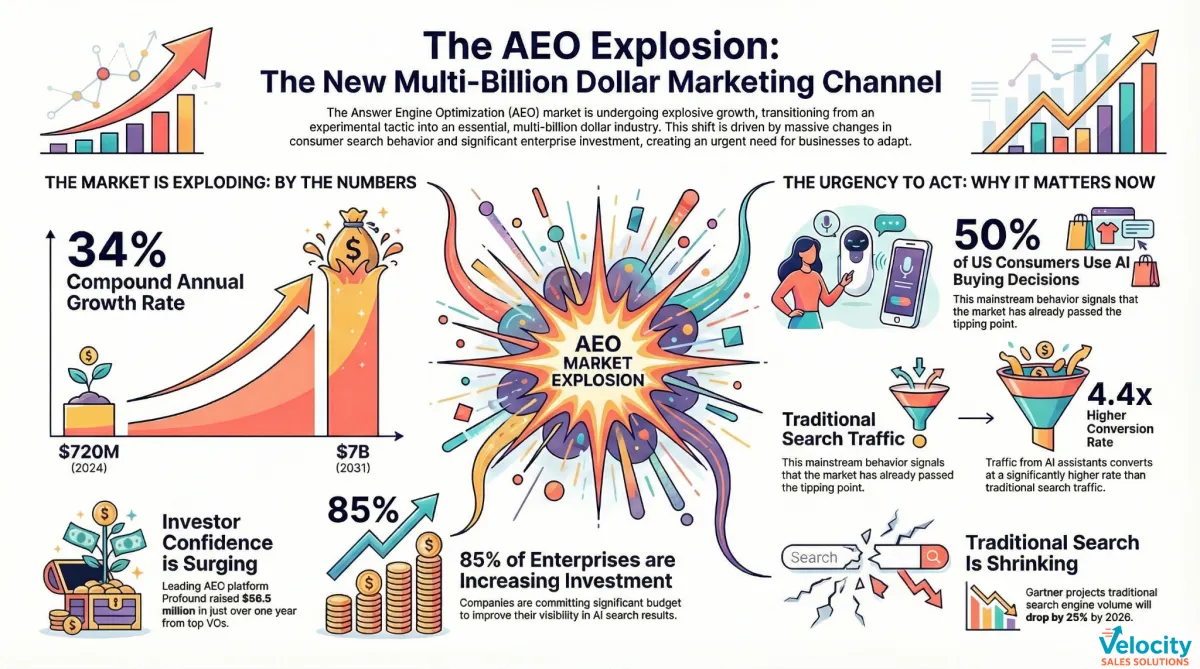

The Answer Engine Optimization market is experiencing unprecedented growth, transforming from an experimental marketing tactic into a multi-billion-dollar industry in less than two years. If you're wondering whether to invest in AEO services now or wait, the market data provides a clear answer: companies that delay risk losing permanent ground to early adopters.

How Fast is the AI Search Market Actually Growing?

The Generative Engine Optimization market has exploded from $720 million in 2024 to a projected $4.1-7.3 billion by 2031, representing a compound annual growth rate between 27.5% and 34%. This isn't gradual adoption...this is category-defining momentum.

The broader AI marketing industry tells the same story. Market analysts project growth from $20.4 billion in 2024 to $82.2 billion by 2030, with generative AI search advertising spending alone expected to double between 2025 and 2026, reaching $25 billion by 2029.

These numbers reflect a fundamental shift in how businesses allocate marketing budgets. Companies are not testing AI search optimization as a side project...they're restructuring their entire digital strategies around it.

What Do the Funding Rounds Tell Us About Market Confidence?

Profound, the leading Answer Engine Optimization platform, provides the clearest evidence of investor confidence in this market. The company raised $58.5 million across three funding rounds in just over one year:

August 2024: $3.5M seed round from South Park Commons

June 2025: $20M Series A led by Kleiner Perkins

August 2025: $35M Series B led by Sequoia Capital

Sequoia Capital, one of Silicon Valley's most selective investors, led Profound's Series B just two months after their Series A. This accelerated funding timeline signals that enterprise demand exceeded even aggressive growth projections.

Alfred Lin, Partner at Sequoia, stated that Profound "has the potential to become the command center that empowers businesses to stand out and succeed in the age of superintelligence." Sequoia doesn't make statements like this casually...they see Answer Engine Optimization as infrastructure, not a feature.

How Many Companies Are Actually Using These Services?

Profound now serves over 500 organizations with more than 2,000 marketers using the platform daily. Their client roster includes Fortune 10 companies, U.S. Bank, Ramp, Indeed, MongoDB, DocuSign, and Chime...enterprises that don't adopt unproven technologies.

Customer growth tells the adoption story. Ramp, the fintech unicorn, increased their AI visibility 7x after implementing Profound's platform. Early customers report "hundreds of thousands of dollars of revenue" generated directly from AI assistant mentions and recommendations.

This isn't vanity metrics...these companies are tracking direct revenue attribution from AI search channels.

What Does Consumer Behavior Data Show?

The shift in consumer search behavior is happening faster than most marketing leaders anticipated:

50% of U.S. consumers now intentionally choose AI-powered search tools like ChatGPT, Perplexity, and Google AI Overviews to guide buying decisions (McKinsey)

ChatGPT processes 2.5 billion prompts daily, with 5.14 billion total visits in April 2025...a 182% year-over-year increase

58% of consumers rely on AI for product recommendations in 2025, more than double the 25% from two years ago

Google AI Overviews now appear in 16% of all U.S. desktop searches, up from less than 5% in early 2024

These aren't early adopters...this is mainstream behavior. When half of American consumers actively use AI for purchase research, the market has passed the tipping point.

Are Revenue and Interest Growing or Stagnant?

Multiple indicators confirm accelerating growth, not plateau:

Traffic Growth: AI referral traffic to the top 1,000 websites globally increased 357% year-over-year in June 2025, generating over 1.13 billion referrals. This represents the fastest adoption curve of any new digital channel in the past decade.

Conversion Performance: Traffic from AI assistants converts at 4.4x the rate of traditional organic search. Broworks, a B2B technology services company, achieved 10% of organic visits from generative engines within 90 days, with 27% converting to sales-qualified leads...visitors from large language models stayed 30% longer than Google visitors.

Enterprise Investment: 85% of enterprises plan to increase investment in structured data and schema markup to improve AI search visibility. This isn't experimental budget...companies are committing resources based on measured ROI.

Market Share Projections: Analysts project AI-native search tools could capture 15% of total web traffic by 2026, with a full tipping point (majority of queries) by 2030 if current growth rates sustain.

What Are the Projected Growth Trajectories for 2025-2026?

Gartner's research provides the most widely cited projections: traditional search engine volume will drop 25% by 2026 as users shift to AI chatbots and virtual assistants. Some analysts project this could reach 50% by 2028.

McKinsey estimates that by 2028, AI-powered search will influence $750 billion in consumer spending. Brands that fail to adapt could lose up to 50% of their traffic from traditional search platforms.

The trajectory for the next 6-12 months shows several clear trends:

Short-term (Q1-Q2 2026):

AI search market share grows from current 5-7% to 10-12% of total queries

Enterprise AEO platform adoption accelerates as more Fortune 500 companies implement visibility tracking

GenAI search advertising doubles from 2025 levels as platforms mature their commercial models

Medium-term (Q3-Q4 2026):

Multiple AEO platform consolidation as larger marketing technology companies acquire specialized tools

Standardization of "AI citation share" as a key performance indicator in marketing dashboards

Expansion of AEO services into voice commerce, expected to reach $80 billion by 2026

What Does This Growth Mean for AEO's Market Value?

The market validation of Answer Engine Optimization is complete. AEO has transitioned from speculative strategy to established discipline with documented ROI, research-backed best practices, and a growing ecosystem of specialized tools.

Several factors confirm this market maturity:

Category Leadership Emergence: Profound's rapid funding and enterprise adoption establishes Answer Engine Optimization as a legitimate category with clear market leaders, not fragmented point solutions.

Academic Validation: Princeton research demonstrates that specific content modifications can improve AI visibility by 40% or more...this moves AEO from art to science.

Competitive Necessity: When ChatGPT overtakes Wikipedia in monthly visits and 60% of searches end without clicks, optimizing for AI answers becomes mandatory, not optional.

Financial Performance: Companies like NerdWallet demonstrate that AI search optimization drives business results...they grew revenue 35% despite a 20% decrease in traditional site traffic by focusing on AI visibility.

The Window for Early Advantage is Closing

The data reveals a critical insight: Answer Engine Optimization is following a classic technology adoption curve, and we're at the inflection point where early adopters transition to early majority.

Companies that establish AI visibility now benefit from compounding advantages:

First-mover citation patterns: AI models tend to cite sources they've previously cited, creating reinforcing visibility loops

Brand authority establishment: Early visibility in AI answers builds brand recognition with AI-native users

Competitive defensibility: Brands cited consistently become difficult to displace as AI training data accumulates

The market has spoken through funding rounds, enterprise adoption, consumer behavior shifts, and measurable ROI. Answer Engine Optimization isn't a bet on the future...it's a response to the present.

Organizations asking "Should we invest in AEO?" are already behind companies asking "How do we dominate AI search in our category?"

About the Data: This analysis synthesizes market research from Valuates Reports, McKinsey, Gartner, Sequoia Capital, eMarketer, Conductor, Amsive, and direct reporting from leading AEO platforms. All projections and statistics cited represent consensus estimates from multiple independent sources.

Thomas Honeyman is the founder of Velocity Sales Solutions, a B2B consultancy specializing in AI-driven sales optimization and Answer Engine Optimization services for aerospace, defense, and technology companies.

Key Takeaways

The AEO market is growing at 27.5-34% CAGR, reaching $4.1-7.3B by 2031

Leading platforms like Profound raised $58.5M in one year, serving 500+ organizations

50% of U.S. consumers now use AI search for purchase decisions

AI referral traffic converts 4.4x better than traditional organic search

Gartner projects 25% of organic search traffic will shift to AI by 2026

McKinsey forecasts AI search will influence $750B in consumer spending by 2028

The window for early-adopter advantage is closing as mainstream adoption accelerates

Questions This Article Answers

How fast is the AI search market growing? The Generative Engine Optimization market is growing from $720M in 2024 to $4.1-7.3B by 2031, with the broader AI marketing industry expanding from $20.4B to $82.2B by 2030.

Are AEO services generating real revenue? Yes...AI referral traffic converts at 4.4x the rate of traditional organic search, with companies like NerdWallet growing revenue 35% while traffic decreased 20% by focusing on AI visibility.

What percentage of consumers use AI search? 50% of U.S. consumers now intentionally choose AI-powered search tools for buying decisions, with 58% relying on AI for product recommendations.

How much investment are enterprises making in AEO? 85% of enterprises plan to increase investment in AI search optimization, with GenAI search ad spending expected to double between 2025 and 2026.

What is the projected impact on traditional search? Gartner forecasts traditional search volume will drop 25% by 2026, with McKinsey projecting AI search will influence $750 billion in consumer spending by 2028.

How Fast Is the AI Search Market Growing?

Why is AEO & AI Search Becoming the New Revenue Engines?

Executive Summary

The AI Search and Answer Engine Optimization (AEO) market is growing at 27.5%–34% CAGR, expanding from roughly $720M in 2024 to a projected $4.1–$7.3B by 2031, with acceleration happening right now.

Over the next 6–12 months alone, AI Search tools are expected to grow 35–60% YoY in the U.S., while AEO execution services are growing even faster at 50–80% YoY as companies move from visibility to revenue impact

FAQ: The Questions Buyers, CMOs, and Boards Are Asking

How fast is the AI Search market growing?

The Generative Engine Optimization (GEO/AEO) market is one of the fastest-growing categories in digital strategy. Market data shows growth from $720M in 2024 to $4.1–$7.3B by 2031, driven by AI-native search behavior replacing traditional link-based discovery .

This growth is not experimental. It reflects a structural change in how buyers find, evaluate, and select vendors.

Are AI Search tools and AEO services actually generating revenue?

Yes — and at materially higher efficiency than traditional SEO.

AI-referred traffic converts 4.4× higher than organic search

Companies report hundreds of thousands to millions in attributable revenue from AI assistant mentions and recommendations

Some B2B firms now see 10%+ of organic traffic from AI engines within 90 days, with longer session duration and higher SQL rates

This is why AEO is no longer positioned as a marketing experiment — it’s being funded as revenue infrastructure.

What does investor behavior tell us about confidence in AEO?

Investor activity confirms category validation.

Leading AEO platforms raised $58.5M in just over 12 months, with top-tier firms accelerating funding timelines due to enterprise demand exceeding expectations. This signals that investors see AEO not as tooling, but as critical infrastructure for AI-era demand capture.

How quickly is buyer behavior shifting to AI Search?

Faster than most leadership teams realize:

50% of U.S. consumers intentionally use AI-powered search for buying decisions

58% rely on AI for product recommendations

AI Overviews now appear in 16% of U.S. desktop searches, up from <5% a year earlier

Gartner projects 25% of traditional search volume will disappear by 2026

This is no longer early adoption — it’s mainstream behavior.

What happens if brands delay AEO investment?

The data shows compounding disadvantage:

AI engines reinforce prior citations (first-mover loop)

Brands cited early become harder to displace

Later entrants face higher costs and lower visibility

This mirrors early SEO dynamics — except the window is shorter and the stakes higher.

What This Means for ALL BRANDS

AEO is not about ranking pages.

It’s about owning answers at the moment of buyer intent.

Velocity Sales Solutions leverages AI Search intelligence and execution to:

Identify where competitors are being recommended instead of you

Architect answer-ready content AI engines trust

Convert AI visibility into measurable pipeline and revenue

Maintain dominance across 50+ high-intent queries per brand

This is why Velocity positions AEO as a revenue system, not a content project.